Objective

Develop a compliant, user-centered FinTech platform with an integrated Loyalty Club that aligns with Melal’s brand values, regulatory standards, and customer engagement goals.

Defining the Problem and Initial Requirements Gathering

Objective: Establish a foundational understanding of Melal’s needs, regulatory limitations, and business objectives.

- Stakeholder Meetings: Conducted multiple sessions with Melal’s top management to gather detailed requirements and understand strategic priorities. These discussions clarified regulatory constraints from the Central Bank and identified customer engagement as a core focus.

- Documentation: Created essential project documentation, such as:

- Product Backlog: Prioritized list of features, incorporating compliance needs, key functionalities for the website, and loyalty program requirements.

- Project Charter and Scope Document: Defined the project’s scope, objectives, and expected deliverables, aligning with Melal’s business strategy.

- Problem Statement: Developed a clear problem statement to guide the team’s focus and objectives, addressing Melal’s need for a digital transformation that complied with banking regulations while enhancing customer engagement.

Cross-Functional Agile Team Building and Planning

Objective: Assemble a team with relevant expertise and structure the project for an agile, collaborative approach.

- Team Assembly: Brought together specialists across UX/UI design, development, data analysis, and compliance within MAAT Holding to form a cohesive, cross-functional team.

- Agile Planning:

- Set up Sprint Cycles to divide the project into iterative phases, allowing for regular reassessment and adaptation based on stakeholder feedback and regulatory adjustments.

- Created Sprint Backlogs for each cycle, detailing specific tasks aligned with milestones, such as wireframe creation, feature implementation, and compliance checks.

- Project Roadmap and Milestones: Established a timeline that mapped each phase, from initial design to final testing and launch, ensuring transparency and accountability for each team member.

Strategic Design Thinking and Brand Alignment

Objective: Use a design-thinking approach to align the project with Melal’s brand values, user needs, and business goals.

- Empathize and Define Phases:

- Conducted User Research and Persona Development to understand customer pain points and preferences, especially regarding digital banking experiences.

- Defined core personas, such as frequent banking users and rewards-oriented customers, to ensure the platform catered to both engagement and loyalty-building objectives.

- Ideation and Prototyping:

- Organized brainstorming sessions to outline potential features for the Loyalty Club, like tiered rewards and customized incentives.

- Aligned features with Melal’s brand values (trust, reliability, innovation) and market positioning as a customer-focused financial institution.

- Developed Strategic UI/UX Documentation to serve as a blueprint for the platform, including key workflows, user journey maps, and interaction principles.

- Brand and Compliance Checkpoints:

- Regularly reviewed features and design components with Melal’s compliance team to ensure that all elements met Central Bank regulations.

UI/UX Design and Development

Objective: Create a user-centered, compliant interface that enhances usability and supports Melal’s business objectives.

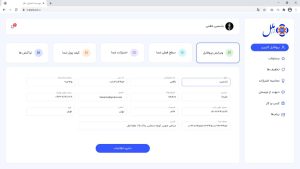

- Wireframes and Mockups:

- Designed low-fidelity wireframes for the website and Loyalty Club, focusing on ease of navigation, accessibility, and engagement.

- Created high-fidelity mockups that showcased Melal’s branding through color schemes, typography, and visual hierarchy.

- User Testing and Iteration:

- Conducted user testing sessions with mockups to gather feedback on usability and feature preferences, particularly for loyalty rewards and transaction flows.

- Implemented changes based on user feedback, such as simplifying navigation paths for loyalty rewards and incorporating visual cues for secure banking interactions.

- Coding and Development:

- Managed front-end and back-end development to implement the UI and key features, such as user registration, transaction tracking, and reward redemption.

- Collaborated with the compliance team to ensure data security standards were met, including data encryption and secure authentication protocols.

- Set up continuous integration/continuous deployment (CI/CD) pipelines to facilitate efficient testing and deployment, allowing for quick iterations based on ongoing feedback.

Testing and Quality Assurance

Objective: Ensure the platform is functional, secure, and meets all regulatory requirements.

- Functional and Compliance Testing:

- Conducted functional testing on all core features, including the loyalty rewards system, transaction flows, and account management, ensuring they worked as intended.

- Performed compliance testing in collaboration with legal teams to verify adherence to Central Bank requirements.

- User Acceptance Testing (UAT):

- Organized UAT sessions with Melal representatives to validate the platform’s usability and effectiveness in meeting customer needs and regulatory standards.

- Addressed any issues raised during UAT, implementing final adjustments to align the platform with Melal’s expectations and Central Bank guidelines.

Go-to-Market Strategy and Launch Preparation

Objective: Define the launch and marketing plan to introduce the platform to Melal’s customers and achieve business impact.

- Launch Strategy:

- Coordinated a phased rollout, beginning with a soft launch to a select group of users to monitor performance and gather early feedback, followed by a full public launch.

- Collaborated with Melal’s marketing team to establish the go-to-market strategy, which included website launch announcements, introductory offers, and loyalty program promotions.

- Marketing Campaigns:

- Designed marketing campaigns to highlight key features of the platform, such as loyalty rewards and easy online access to banking services.

- Recommended targeted digital advertising strategies to attract core personas, utilizing channels like social media, email newsletters, and in-app notifications.

- Onboarding and Support:

- Developed user onboarding flows and support resources, including a tutorial for new users on how to access the Loyalty Club and manage their accounts.

- Established a customer support protocol to address initial user inquiries and provide real-time assistance during the launch period.

Post-Launch Analysis and Iteration

Objective: Analyze platform performance and refine based on user data and business feedback.

- Performance Monitoring:

- Set up KPIs to measure platform success, including active users, engagement rates, reward redemption rates, and customer satisfaction scores.

- Data-Driven Optimization:

- Analyzed user behavior and feedback to identify areas for improvement, such as optimizing reward tiers or streamlining account management processes.

- Implemented updates based on this data, enhancing features to drive higher engagement and support Melal’s long-term goals.

Outcome

The successful launch of the FinTech website and Loyalty Club platform positioned Melal as a leader in digital banking innovation within Iran’s finance sector. By aligning regulatory compliance, user-centric design, and Melal’s brand vision, the project enhanced customer engagement and established a strong foundation for Melal’s digital growth.

Through this project, I demonstrated my ability to manage complex digital transformations, lead agile, cross-functional teams, and design strategic, research-driven solutions that meet regulatory, business, and user needs.

Conclusion

Leading this project for Melal Finance and Credit Institute was a rewarding experience that challenged me to bridge strict regulatory requirements with an innovative, user-centered approach. By collaborating closely with Melal’s leadership, I led a cross-functional team to deliver a platform that not only complied with Central Bank standards but also engaged customers through a loyalty-driven digital experience. This journey—from initial strategy and design through agile development and go-to-market execution—reinforced my commitment to creating digital solutions that align with business goals while elevating user experience.