Project Overview

When I joined Coimex, the Defi platform was underperforming and fraught with challenges. Over 3 years and 6 months as the Technical Product Manager, I led a multi-phased transformation that redefined product strategies, rebuilt the team structure, and integrated cutting-edge technologies. Below is an in-depth look at this transformative journey.

Phase 1: Strategic Assessment and Roadmap Definition

During the initial months, I performed an exhaustive analysis to identify weaknesses and craft a robust strategy:

PESTEL Analysis:

- Political: Evaluated regulatory landscapes and compliance risks

- Economic: Assessed market fluctuations and investment climates

- Social: Identified customer behavior trends and adoption barriers

- Technological: Analyzed emerging tech stacks and integration potential

- Environmental: Considered sustainability and operational efficiency

- Legal: Reviewed legal frameworks impacting DeFi and blockchain

Product Analysis and Stakeholder Engagement:

- Conducted over 50 stakeholder interviews including C-level executives, technical leads, and end users

- Utilized affinity diagramming to cluster pain points into actionable insights

- Organized 10+ innovation workshops to ideate and prioritize solutions

Roadmap & Strategy Definition:

- Developed a detailed 12-month product roadmap

- Defined KPIs for market re-entry and product performance

- Established cross-functional teams for execution, integrating Agile and Scrum methodologies

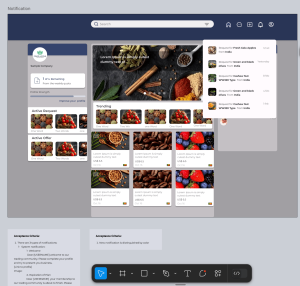

Phase 2: UX Redesign and Initial Market Relaunch

With strategic plans in place, the focus shifted to refining the user experience and repositioning the platform:

User-Centric Design Initiatives:

- Held weekly customer feedback sessions to capture real-time insights

- Implemented comprehensive UX/UI audits using tools like Hotjar and Figma

- Designed and executed multiple A/B tests to optimize user flows

Value Proposition and Market Penetration:

- Redesigned the value proposition based on segmented customer personas

- Represented Coimex at over 15 international fintech and blockchain fairs

- Tailored communication strategies to meet diverse regional market needs

Technical Enhancements:

- Overhauled backend architecture using microservices to improve scalability

- Enhanced API integrations with RESTful services and GraphQL for efficient data retrieval

- Incorporated robust data analytics tools to monitor user behavior and performance metrics

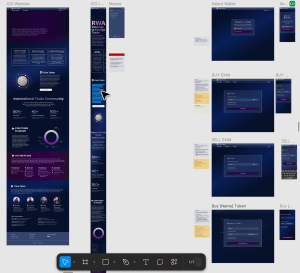

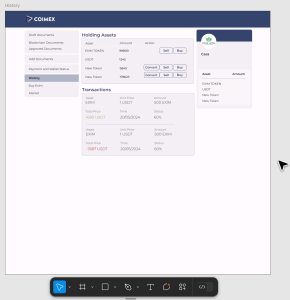

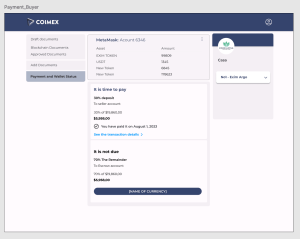

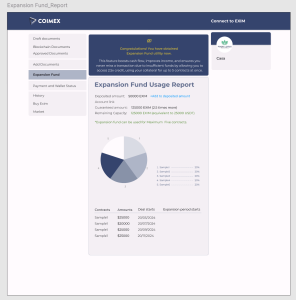

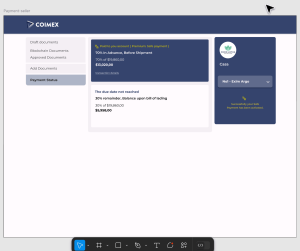

Phase 3: Web3 Integration and V2 Platform Development

Following the successful relaunch of the initial version, we initiated a major upgrade to introduce Web3 functionalities and advanced financial features:

Blockchain and Smart Contract Implementation:

- Developed and deployed smart contracts on Ethereum Chain

- Integrated decentralized governance models for transparent decision-making

- Utilized Solidity for smart contract development and automated testing frameworks (Truffle, Hardhat)

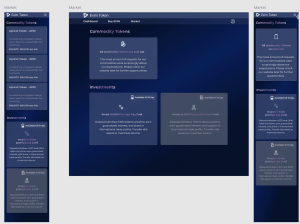

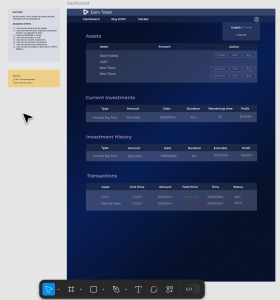

Advanced DeFi Features:

- EXIM Trading Module:

- Designed to handle complex import-export transactions

- Implemented order matching algorithms and liquidity pools for efficient trade execution

- Staking and Yield Farming:

- Integrated staking mechanisms to incentivize asset locking

- Launched yield farming protocols with dynamic APY calculations

- Leveraging and Financial Instruments:

- Developed features for leveraged trading and risk management

- Integrated with third-party APIs for real-time market data and risk analytics

- EXIM Trading Module:

New Technology Stack:

- Transitioned to modern frameworks such as React.js and Node.js for the web application

- Employed containerization (Docker, Kubernetes) for streamlined deployments

- Adopted CI/CD pipelines using Jenkins and GitLab CI to ensure rapid iteration and deployment

Phase 4: Security, Compliance, and Market Validation

Security and trust were paramount, particularly in a finance-centric platform:

Rigorous Security Protocols:

- Integrated multi-factor authentication (MFA) and biometric verifications

- Employed end-to-end encryption for data in transit and at rest

- Implemented real-time fraud detection using machine learning algorithms

Audit and Compliance:

- Successfully completed a comprehensive audit by a reputable German audit firm

- Ensured adherence to international standards (ISO/IEC 27001, GDPR compliance)

- Conducted regular vulnerability assessments and penetration testing

Market Validation and ICO Success:

- Launched a successful ICO, securing significant investments from global backers

- Featured on major platforms such as Binance Live and secured media coverage on leading Turkish TV channels

- Achieved robust token performance and active trading on decentralized exchanges (DEXs)

Phase 5: Scaling the Team and Continuous Innovation

The transformation of Coimex stands as a prime example of leveraging strategic analysis, technical expertise, and innovative thinking to revive a struggling product. By integrating modern technologies, enhancing user experience, and enforcing stringent security measures, we not only re-entered the market but set new benchmarks in the DeFi space. This journey reinforced the importance of a holistic approach—combining technical acumen with strategic foresight—to drive sustainable success in an ever-evolving industry.

Conclusion

The transformation of Coimex stands as a prime example of leveraging strategic analysis, technical expertise, and innovative thinking to revive a struggling product. By integrating modern technologies, enhancing user experience, and enforcing stringent security measures, we not only re-entered the market but set new benchmarks in the DeFi space. This journey reinforced the importance of a holistic approach—combining technical acumen with strategic foresight—to drive sustainable success in an ever-evolving industry.